It is a world of opportunity out there for financial institutions. Whilst you face stiff challenges, you also have potentially great opportunities. There will never be a shortage of consumers who need loans, mortgages, credit cards, insurance, retirement planning and a whole host of other banking requirements. For those financial institutions who want to ensure that they are meeting the evolving needs of these consumers, there is a need to continually expand and refine digital marketing strategies to increase customer penetration and engagement.

One increasingly effective strategy to use in digital marketing for finance businesses is programmatic advertising. Programmatic advertising is the automated, real-time bidding and placement of online ads.

Display advertising has long been recognised as an effective tool of choice for finance businesses. It is a proven way to reach and convert prospects. It serves both to raise brand awareness and to deliver your message repeatedly. It can build consumer trust and substantially increase conversions.

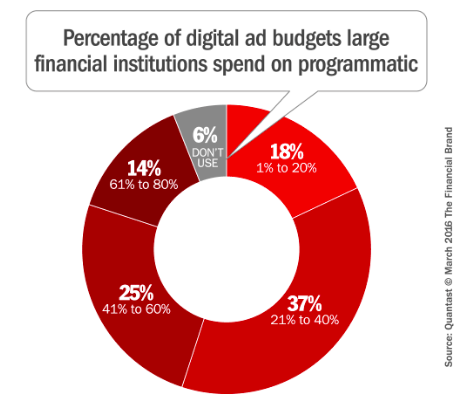

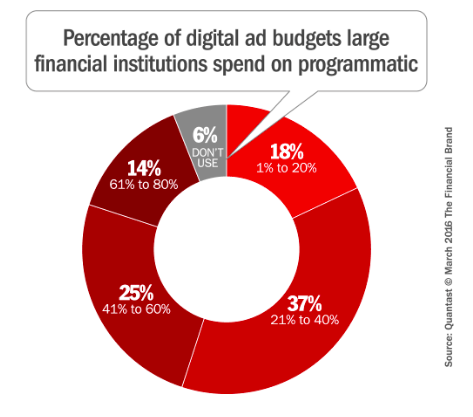

For both EMEA and US large financial companies (over 500 employees) it is estimated that between 2015 and 2017 they will have shifted around 20 to 40% of their digital display budgets to programmatic advertising.

This massive growth of programmatic advertising opens up a whole new area of opportunity for more effective targeted advertising at every stage of the finance customer’s journey. Make sure you do not miss the boat!

Like any other form of advertising, programmatic advertising needs to begin with your target audience. Not only that, but you need to be able to reach that audience on the devices that they are using. Quantcast – the sources of the above infographic – also discovered that 51% of large financial brands derive over 41% of their overall web traffic from users on mobile devices.

Programmatic advertising enables you to tap into this opportunity by automating the purchase and delivery of relevant ads to customers at the right time and on the right device. It is able to recognise the users visit as an impression, in turn giving you the ability to interact with consumers on whatever device they are using and wherever they are on the customer journey.

Let’s look at three more specific examples of how programmatic advertising can help you do this.

- Attracting new customers

Programmatic advertising can form a valuable part of your general digital marketing strategy to attract new customers to your site by capturing the attention of people who match your ideal customer profile and who are in the initial consideration stages of their customer journey. For example, strategic placement of a product ad on a news website that your target customer is likely to browse. - Retargeting current prospects

Programmatic advertising can also be invaluable to follow up prospective customers who have shown some signal of interest but have not yet converted. For example, you may choose to retarget those who have abandoned a basket and not yet returned. Retargeting these potential customers by showing a relevant ad the next time they are online can significantly increase your chances of encouraging them to convert. - Uncovering untapped audiences

One of the key strengths of programmatic advertising is that it can help you to uncover untapped audiences, and then do some niche real-time targeting to capture those audiences. Quantcast have a lovely example of this.A global financial services provider wanted to target frequent fliers for a promotion for its high-end airline credit card. However, during data analysis of real-time web activity to establish the browsing patterns of frequent fliers, a new customer segment was uncovered. In addition to flight information, a significantly large number of applicants were also researching animation and comics. It emerged that there were two major comics conventions along the promoted route that tied in with the credit card promotion dates. Using this data enabled Quantcast to target this new segment with relevant messages in real time; resulting in this segment comprising 35% of the total conversions that signed up to the credit card.

For any of the above scenarios, programmatic advertising can dramatically improve the success of your digital marketing for finance businesses. Its ability to use and apply in-depth data analysis is fundamentally changing the way in which advertising is bought and sold.

We hope that the above steps will help you use programmatic advertising more effectively as part of your Digital marketing for finance businesses . If you need any further help or advice on this then do get in touch to see how we can help you move forward.