Under the provisions of the The Small Business, Enterprise & Employment Act 2015, nine leading high street banks are now obliged to offer to refer all small business loan applicants that they reject to independent finance organisations.

Applicants will then be contacted with offers from a range of alternative lenders who may be able to help. Not only will this result in more small businesses obtaining the funding they need from reputable sources, but it will also boost competition in the small business loan market.

So who are these alternative lenders? They include a broad range of independent financial organisations and online platforms. The referral process is overseen by three independent finance portals: Funding Options, Funding Xchange and Bizfitech.

At Xcite we are pleased to say that we have already been involved in this initiative in a number of ways.

Firstly we have worked with both Funding Options and Funding Exchange to develop a bespoke API to handle the secure transfer of the data of loan applicants. An API – Application Program Interface – enables data to be shared between different software applications without human intervention. It has become the accepted standard for sharing data and one of the many benefits is that it enables open banking.

When a lender has access to bank account data via an API to assist with lending decisions it can be transforming to the whole process of SME lending. Lenders are empowered to have instant yet secure access to the financial information of the applicant – such as credit checks and affordability – thus enabling fast lending decisions to be made.

Our involvement with Funding Options dates back to the very the early days of API’s being introduced into the UK. In fact the Funding Options API was mentioned in in HM Treasury’s report “Data Sharing and Open Data for Banks”.

API is crucial to the success of the new bank referral system because of its enabling of open banking and also because it can handle large amounts of data so makes it possible for organisations to become platforms for third party innovation. In both these ways, SME funding is now becoming an emerging data-driven journey that will have more chance of arriving at its destination than ever before!

Another way in which we have been involved is that one of our major clients – Fair Business Loans – is one of the alternative lenders selected to be part of the new initiative. Fair Business Loans are a not for profit finance company who are passionate about providing reputable finance to help small businesses grow.

Under the new scheme they are one of the selected alternative small business loan providers for applicants rejected by the bigger banks. You can read more about the work we have done with Fair Business Loans here.

We are proud to be part of both the above initiatives. As a small business ourselves, what better than to work with Government approved schemes and clients, to play our part in helping SME’s.

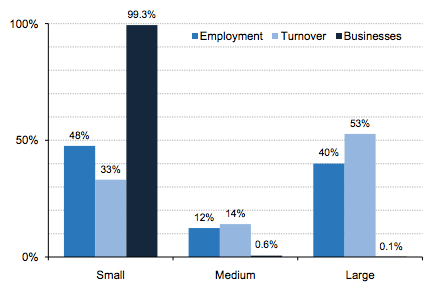

Given the numbers above, the impact of The Small Business, Enterprise & Employment Act 2015 could be phenomenal and we are delighted to have been part of it!

Author: Emily Williams