Does the financial services industry really need digital marketing? There are distinct differences between financial organisations and other types of business. Some of these are self-evident, such as the restrictive regulatory constraints under which they operate, and the fact that their products and services do not just make money but they are money.

It’s therefore not surprising that in some ways, that the financial services industry as a whole is somewhat lagging behind the rest of the world in terms of digital marketing. Until relatively recently the sector has been defined by its consistency and stability, without a need to do anything particularly different. So many finance businesses have come a little late to the party in this respect. However, now they have arrived, it’s time to look at effective digital marketing for finance businesses.

The recent 2017 Digital Trends in Financial Services and Insurance report highlighted a key change that is now occurring in the financial services industry in terms of marketing aims. Whilst these have up till now been very focussed on products and services, there is now a major shift towards emphasising customer journeys. This sea change – coupled with the constant disruption of new technologies and changing data regulations – means that finance businesses increasingly need to keep pace with their competitors in terms of their digital marketing activity.

The report found that whilst 51% of businesses surveyed felt that digital permeates most of their marketing activities, only 9% of businesses claimed to be “digital-first” organisations. This compares to 13% in the retail industry. Respondents cited the following priorities to become more digital-first:

- prioritising customer experience – 67%

- optimising the customer experience – 34%

- customer journey management – 31%

- increased investment in personalisation- 55%

There is also a deep desire to use data more effectively. 99% of respondents consider “improving data analysis capabilities” to be essential to gain a better understanding of customer experience requirements, and 53% intend to increase their marketing analytics budget over the next year. However, many respondents are held back from making full use of data, partly due to concerns over privacy regulations but also due to complications over legacy data storage systems, and incompatibility between different strands of data. Only 64% of businesses feel that they have “access and control over customer and marketing application data” – as compared to an average of 75% across other sectors.

In light of all the above aspirations, how can digital marketing for finance businesses work in the real world? Are there examples of finance businesses in the UK who are using digital marketing effectively?

The answer to this is yes! At Xcite Digital we have an impressive track record of using digital marketing to drive new leads for consumer finance businesses. Over the past 15 years we built up using historical insight into financial verticals, and now have an in depth understanding of how to appeal to financial audiences.

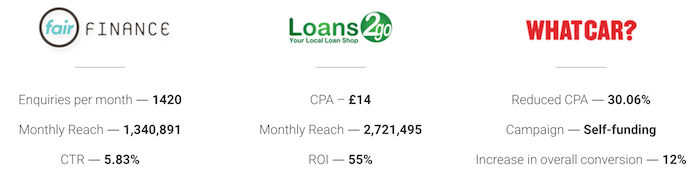

Our work with digital marketing for finance businesses has achieved tangible results. We appreciate the importance that you rightfully place on numbers and with our financial clients have been able to reduce CPA and maximise ROI whilst simultaneously winning more business. Have a look at an example of our work here.

Our specialism is working with clients to create a comprehensive cross-channel marketing programme. This will map out your customers’ journeys and use event tracking and analytical data to appeal to consumers at different touch points, with the aims of improving their overall user experience and maximising conversions.

Whilst we take a personalised approach to all of our clients, some of the strategies that we have used in digital marketing for finance businesses are:

- Conversion rate optimisation: knowing when market share is growing or declining and advising accordingly. As well as presenting your content it the optimum way to drive conversation through design and build.

- PPC campaigns: making sure that your adverts appear at the right place, at the right time, and with the most compelling message

- SEO marketing: helping you get to the top so that you are being seen

- Social input: getting the right mix of social engagement and social advertising

- Inbound content marketing: engaging and relevant content to portray expertise and reinforce the business-customer relationship.

- Driving repeat business through email marketing and developing advocacy through social activity.

So if you are one of the many financial businesses that have a strong desire to become digital-first but need some help in getting there, then why not get in touch to see how we can help?